A good computer is essential for any trader. Below I will highlight the basic components that you need for your day trading PC: hardware, software, Internet connection, and system protection.

Hardware for Trading

Even though I do not have a Ph.D. in computers, I have used and helped people set up computers for day trading on numerous occasions in the past. I also know computer professionals that assist traders who want a high-end computer with specific set ups. Below, I have provided the minimum suggested specifications for day traders as well as the ideal or preferred specs:

- Intel Core i5 Processor (Intel Core i7 preferred)

- 8 GB of RAM or more (16 GB or more of the fastest RAM possible preferred)

- Windows 8.1 Operating System (Windows 7, 64-bit OS preferred)

- Two 21-inch LCD monitors (Two 24-inch LCDs preferred or Four or more screens ideal)

- Note on multiple monitors: your video card has to have two output ports generally in a DVI (preferred) and VGA format. If your video card does not have the capability to support multiple monitors, you will need to install multiple video cards (one per monitor). You can also add one USB display adapter (like Plugable) per monitor if you don’t want to install the video cards, but the video card set-up is my preferred approach.

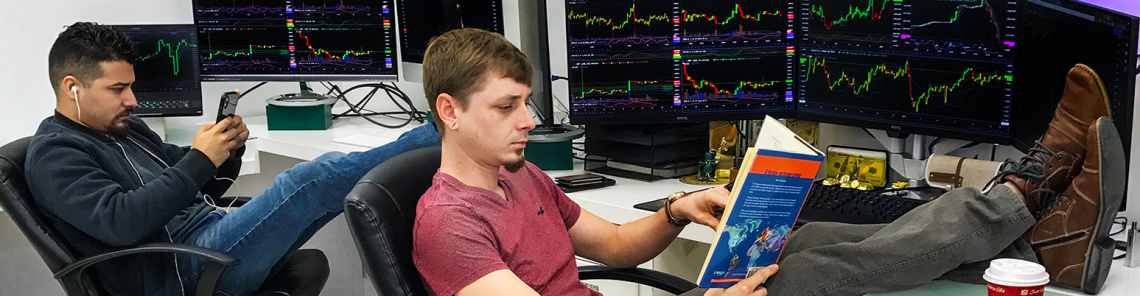

Unless you are a computer expert, try to order the computer exactly like you want it (turnkey), ideally from a firm that specializes in assembling and servicing trading or high-end gaming computers (The above image shows a typical trading computer setup with four (4) monitors connected to the same computer (4-monitor array on a desktop stand). This allows the trader to expand their screen across all monitors as if was one big rectangular area. Thus, more graphs and other market data can be observed by the trader at the same time).

Read about the 5 biggest misconceptions when it comes to trading computers.

Trading Software (the Platform)

Every serious day trader uses a special platform to buy and sell. This trading platform is installed on the computer mentioned above and through it, the trader analyzes stocks, currencies, futures, etc. and places orders associated with his desired asset class(es). Since the platform is the most important component of a complete system, it is very important that it be well-known and widely used by traders. If you are trading stocks, the platform should have the following components available:

- Level II (a list of all the buy and sell orders in the market)

- Time and Sales (list of all transactions ordered by the time of execution)

- Real-time streaming quotes and charts (constantly updated with live market data)

- Portfolio tracker

- Real-time news

- Order entry (built into the software)

Before I switched from trading mostly stocks to currencies (or Forex), I used to use the RealTick platform. I always liked RealTick the best for stocks. Since I first traded stocks, other direct access trading (DAT) brokers have sprung up with proprietary platforms other than RealTick. Depending on the broker and the platform that they offer, this might typically run you between $100 and $500 a month to use for something high-end. If you want to day trade currencies instead (forex trading), you don’t need RealTick. To test drive a powerful trading platform for trading currencies, click here to request a live simulator (A glimpse of the trading platform I use for the simulator is shown on the image above).

Internet Connection

Even if you buy the best computer that is currently available, without a fast Internet connection you cannot receive all of the streaming, real-time information (quotes, charts, transaction information, etc.) provided by your trading software. Here are my suggestions:

- Cable Modem Service (preferred) – Cable Internet speeds can range from about 5 Mbps to about 100 Mbps in speed depending on the service and provider you use.

- DSL (Digital Subscriber Line) – The speed of DSL can range from about 1 Mbps to about 8 Mbps. It is also distance sensitive, which means that the farthest your trading computer is from the central office or hub of the company providing your DSL service, the slower the service will be. This is not the case with Cable (above) or Fiber (below).

- Fiber-Optic Internet Service (ideal) – FTTH (Fiber to the Home) is the gold standard of internet connections. Unfortunately, it is not available in many locations. Residential customers (traders included) in the United States and other industrialized countries are salivating for Fiber. A good example of FTTH is Google Fiber, which can deliver speeds of up to 1000 Mbps. If you are one of the lucky few who has access to fiber-optic broadband, then make sure you eat it all up and spit out the bones! Fiber is especially great for active traders and scalpers that need very low latency or execution delays.

I have used Cable broadband for years and think it’s great. The cost of this service can range between $50 and $100 a month. If you cannot get access to cable internet, then you’ll probably have to bite the bullet with DSL. Another option, if your broker offers it, is to trade in the broker’s office with one of the high-speed computers that are already set up there (usually for an additional fee). Of course, as I mentioned above, if Internet access via Fiber is available in your area, it will make all of the other broadband solutions obsolete, except to be used maybe as backups.

System Protection

Trading computers don’t exist in an Utopian society. In a perfect world, PCs are not affected by computer viruses, damaged by hackers or fried by unexpected surges in electric power. Unfortunately, you trade in a real world where all of these threats are part of life. That is why you NEED TO protect your trading terminal by preparing for the worst!

Antivirus Program

All you have to do is listen to the news today and you will probably hear a story about a new computer virus program that is causing havoc around the world. This is common practice nowadays.

Many viruses have caused quite a stir in the last decade, and have damaged a large number of computers worldwide in the process. A computer usually gets a virus when an infected file is opened by the user. Most people obtain these files as email attachments or links. If your computer is rendered inoperative by a virus, you won’t be able to trade. To avoid this, you should use an antivirus program (Avast is a good one I like. They have a free version too).

Most computers already come from the vendor with one of the popular antivirus programs installed, but many are normally very clunky and slow your computer down a lot. Do a bit of research and read the reviews before making your mind up regarding what you should use.

Firewall

If you use a high-speed Internet connection (like DSL or Cable Modem) you become vulnerable to threats such as hacking or malware.

Hacking is when a person (hacker) breaks into (hacks) your computer from another computer. The hacker then takes control of the computer and can simply spy on you or delete the entire contents of your trading machine.

Malware (short for “malicious software”) is software that is intended to damage, disable or gain access to computer systems. Malware also includes viruses.

Being affected by these threats can be serious setbacks for a trader. To prevent this from happening, a trader can use a “firewall.” A firewall blocks unauthorized access to your trading computer from the outside world.

A firewall can consist of additional hardware and/or software installed on the computer system. The easiest solution to set up is a software firewall. There are tons of different firewall software vendors in the market and many companies that provide free versions of their software. Before deciding on a firewall system, make sure to check the reviews from reputable sites.

Backup System

In a perfect world we wouldn’t need a backup solution, but we don’t live in a perfect world. The most important forms of back-up for trading are:

- DSL or Cable Modem (in case your primary method of accessing the Internet stops working)

- Uninterruptible Power Supply (UPS) for power failures and surges

Even though I’ve experienced very few cases where my Internet has stopped working during trading, it does happen. If you have access to multiple Internet access solutions and your main service goes out, you can simply connect to a backup service; for example, if your Cable service goes out, connect to DSL, etc. Even though DSL might be inferior to your main service, it still will still allow you to trade.

A UPS allows your trading computer to run on back-up power during a blackout. Even though you cannot run on back-up power indefinitely (based on the capacity of the UPS), it does allow you to close out any positions that you do not want to leave open as well as save anything that you were working on.

A UPS will also provide protection from voltage surges that can damage your trading computer. In countries such as the United States and the UK, power is pretty reliable, so if you don’t want to buy a UPS right away when you start trading – that’s OK, but you should at least use a surge suppressor ($20 to $50) to protect your computer from sharp fluctuations in power which can easily damage or shorten the life of your trading equipment.

Read the 5 Biggest Misconceptions About Trading Computers, where you will learn important dos and don’ts when buying a trading PC and find out about a great company that makes computers specifically for traders.