Let me answer your question with another question. Should you bet the house on one spin of the roulette table in Vegas? Not a chance!

The attractiveness of day trading lures many inexperienced investors that risk too much of what they have in the active trading arena. This is a big mistake. In general, an investor should not trade with more than 25% of his entire net worth (preferably, not more than 25% of his liquid net worth; stocks, bonds, CD’s, bank accounts, cash, etc.).

You might ask, “Does that mean that I cannot trade unless my liquid net worth is $100,000 or more?” The answer is, “Only if you want to day trade stocks.” Remember that to day trade stocks you need at least $25,000 in your account by law (preferably $30,000 to give you some margin for error). So, if we use the 25% limitation figure above, you need to have at least $100,000 to be able to day trade stocks with $25,000.

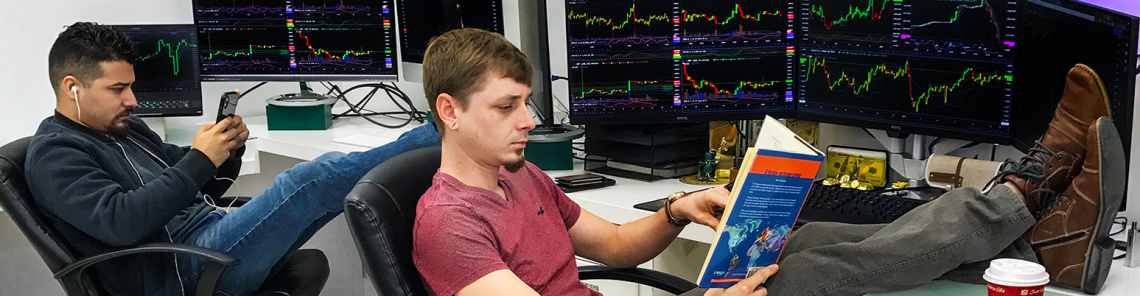

In my opinion, nowadays there are better things to day trade than stocks. “Like what?”, you ask. Like currencies (foreign exchange, or forex).

Currency trading provides many advantages that you can read about on this website, including being able to use very little money to start out. You can open an account with just a few hundred dollars. This means that some may be able to give trading a shot without betting the house. Rather than risking the only $25,000 you may have to trade stocks, you can open a small account and begin your new active trading career.