Americans’ love affair with stocks has caused the delay in many retirements (perpetually in some cases).

This historical credit crisis and real estate bubble blow-up has impacted 401(k) balances across the nation – as well as IRA accounts and non-retirement stock portfolios. Even diversified bond portfolios have gotten whacked, as corporate debt across traditionally “solid” (yeah right!) sectors, such as financial services and insurance, have suffered devastating blows (due to blatant gambling with real estate).

We’ve been warning people against this for years, but unfortunately, the stock-and-bond-centered traditional views of retirement and financial planning are too ingrained in the minds of many investors. It takes a lot of unbrainwashing to bring people out of that spell.

But don’t get me wrong here. I’m not rubbing it in. I feel a lot of sorrow for what our country is going through right now (and it can get A LOT worse). I just want people to throw the traditional investment pyramid in the garbage and open their minds just a little bit. Don’t wait for your stocks to drop to the level of Lehman Brothers (i.e., zero) to take action.

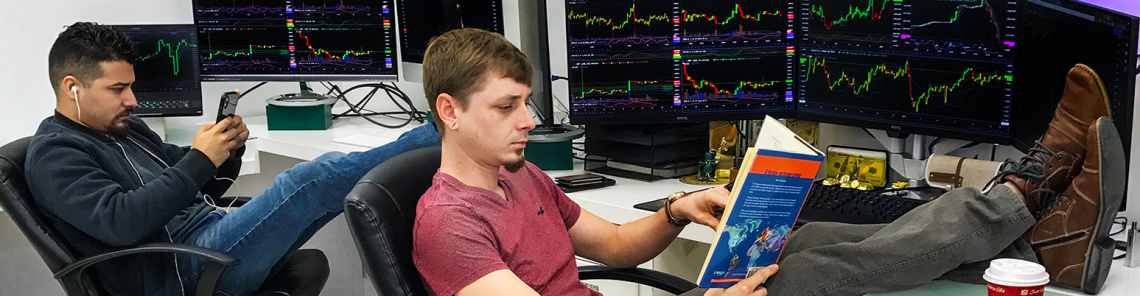

There are other ways to add diversification and safety to your investment portfolio, without lowering your return to that of bank savings accounts. Even though, I’m a fan of day trading (but not with stocks), that should only be a small part of your financial pyramid; assuming you learn to day trade correctly (sign up for our free training and start learning). Most of your pyramid should be composed of investments that provide an attractive return, but with little market risk; investments that your overdressed broker at Merrill doesn’t know about.

During critical times like these, retreating in a fetal position to a dark corner of your closet while sucking your thumb and crying for your momma is not the best solution by far. You need to be proactive and take action early – and don’t wait for any politicians to rescue you (they’re only interested in saving the fat, corporate pigs that caused this mess in the first place).

So what do you do then?